A Biased View of The Wallace Insurance Agency

Table of ContentsAn Unbiased View of The Wallace Insurance AgencyEverything about The Wallace Insurance AgencySome Known Factual Statements About The Wallace Insurance Agency Our The Wallace Insurance Agency IdeasThe Greatest Guide To The Wallace Insurance AgencyWhat Does The Wallace Insurance Agency Mean?Unknown Facts About The Wallace Insurance AgencyMore About The Wallace Insurance Agency

These plans additionally supply some defense element, to assist make certain that your recipient gets monetary compensation needs to the unfavorable take place during the period of the plan. Where should you begin? The simplest way is to begin thinking concerning your priorities and requirements in life. Below are some concerns to obtain you started: Are you searching for greater hospitalisation protection? Are you concentrated on your family's health? Are you trying to conserve a good sum for your youngster's education requirements? Many individuals begin with among these:: Versus a background of increasing clinical and hospitalisation costs, you may desire wider, and higher insurance coverage for clinical expenses.Ankle joint sprains, back sprains, or if you're knocked down by a rogue e-scooter biker., or normally up to age 99.

The Wallace Insurance Agency for Beginners

Depending upon your coverage plan, you obtain a swelling sum pay-out if you are completely handicapped or critically ill, or your liked ones obtain it if you pass away.: Term insurance coverage supplies coverage for a pre-set duration of time, e - Insurance coverage. g. 10, 15, twenty years. As a result of the shorter protection duration and the lack of money worth, costs are normally less than life strategies

When it matures, you will certainly obtain a round figure pay-out. Money for your retirement or kids's education and learning, check. There are 4 typical sorts of endowment plans:: A plan that lasts regarding ten years, and supplies annual cash money benefits on top of a lump-sum amount when it matures. It normally consists of insurance coverage against Complete and Permanent Impairment, and death.

Unknown Facts About The Wallace Insurance Agency

You can select to time the payout at the age when your child mosts likely to university.: This supplies you with a regular monthly earnings when you retire, typically in addition to insurance coverage.: This is a way of conserving for temporary goals or to make your money job harder versus the forces of rising cost of living.

Fascination About The Wallace Insurance Agency

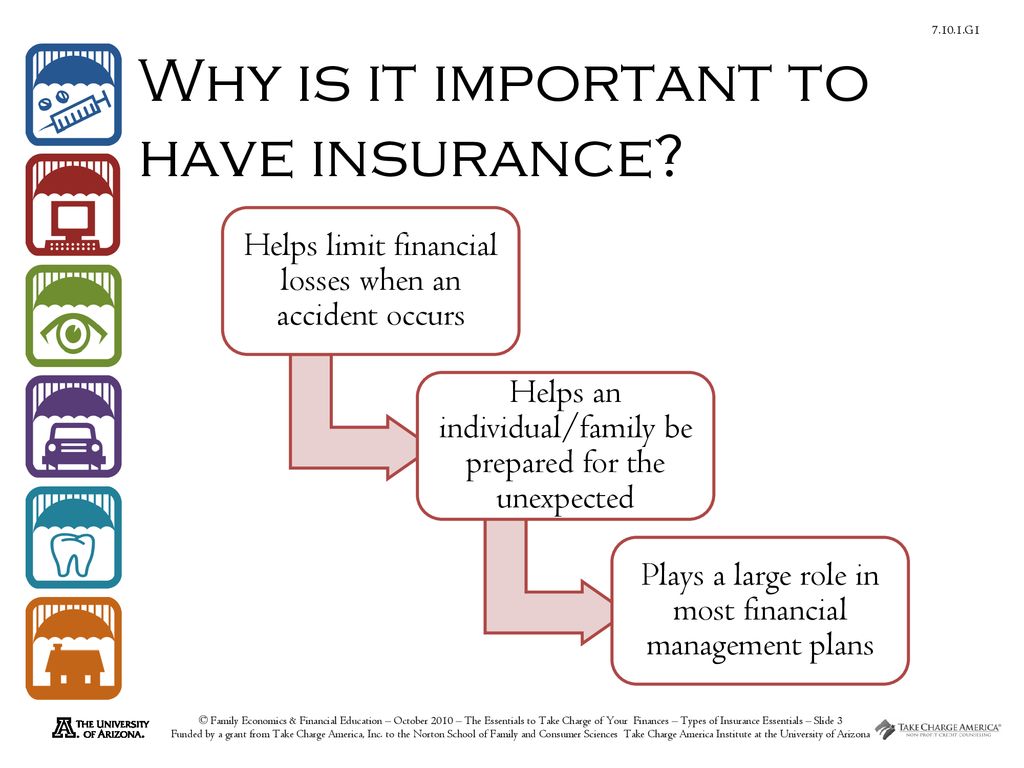

While obtaining different plans will certainly offer you more comprehensive coverage, being extremely protected isn't a good idea either. To stay clear of unwanted monetary tension, contrast the plans that you have versus this list (Home insurance). And if you're still not sure concerning what you'll need, just how much, or the kind of insurance policy to obtain, seek advice from an economic advisor

Insurance is a long-term dedication. Constantly be sensible when making a decision on a strategy, as switching or terminating a strategy too soon typically does not generate economic advantages.

The Wallace Insurance Agency - Truths

The ideal part is, it's fuss-free we immediately exercise your money flows and give money suggestions. This article is indicated for info only and should not be trusted as economic recommendations. Prior to making any type of decision to acquire, offer or hold any kind of financial investment or insurance item, you must consult from an economic adviser concerning its suitability.

Spend only if you understand and can check your investment. Expand your investments and prevent spending a huge section of your money in a solitary product company.

The Best Strategy To Use For The Wallace Insurance Agency

Life insurance policy is not constantly the most comfy topic to discuss. Just visit this site right here like home and auto insurance coverage, life insurance policy is vital to you and your household's financial safety and security. Parents and working adults usually need a sort of life insurance policy plan. To help, allow's explore life insurance policy in extra information, how it functions, what value it may supply to you, and exactly how Bank Midwest can aid you find the right plan.

It will assist your household repay financial debt, receive earnings, and get to significant economic goals (like university tuition) in the event you're not here. A life insurance policy plan is fundamental to preparing out these monetary considerations. In exchange for paying a monthly premium, you can get a collection quantity of insurance policy protection.

An Unbiased View of The Wallace Insurance Agency

Life insurance coverage is appropriate for almost every person, even if you're young. Individuals in their 20s, 30s and even 40s commonly overlook life insurance - https://xqud79qxa4u.typeform.com/to/YWtUoKMB. For one, it needs dealing with an awkward question. Numerous younger individuals also think a plan just isn't appropriate for them offered their age and family scenarios. Opening a plan when you're young and healthy can be a clever selection.

The even more time it requires to open a plan, the even more threat you deal with that an unforeseen event can leave your family members without insurance coverage or financial assistance. Relying on where you go to in your life, it is essential to understand specifically which type of life insurance is ideal for you or if you need any type of whatsoever.

3 Easy Facts About The Wallace Insurance Agency Described

A property owner with 25 years continuing to be on their mortgage might take out a plan of the very same size. Or allow's claim you're 30 and plan to have children quickly. Because instance, signing up for a 30-year policy would secure your costs for the following three decades.